Loan Estimate

Loan Estimate Explained *

The Loan Estimate tells you important details about the loan you have requested. The lender must provide you a Loan Estimate within three business days of receiving your application.

The Loan Estimate is a form that took effect on Oct. 3, 2015. When you receive a Loan Estimate, the lender has not yet approved or denied your loan application.

The Loan Estimate shows you what loan terms the lender expects to offer if you decide to move forward. If you decide to move forward, the lender will ask you for additional financial information.

Page 1

Loan Terms

Desjardins Bank offer adjustable Mortgage Rate (ARM). A variable-rate mortgage, (ARM), is a loan with the interest rate on the note periodically adjusted based on an index which reflects the cost to the lender of borrowing on the credit markets. The loan may be offered at the lender's standard variable rate/base rate.

Projected Payments

In this section, you will find informations about your futur mortgage payments, your property taxes and any insurance payments.

What In escrow means ?

Both in real estate and other areas, escrow accounts are what is used prior to a sale officially going through.

Also, an escrow account is used after the buyer moves into the home, as the mortgage lender pays money owed on property taxes and homeowners insurance out of the escrow account, funded by the buyer. Minimum balances are often required in an escrow account. For mortgage lenders and homeowners alike, an escrow account can work as a safety measure to help ensure payments get made on time with money saved away for these payments.

Closing Costs

Here you will find information about the total amount you will have to pay at closing, in addition to any money you have already paid.

The estimated closing cost refer to what you will be charged to get your loan and transfer ownership of the property. Also sometimes referred to as “settlement costs.”

Page 2

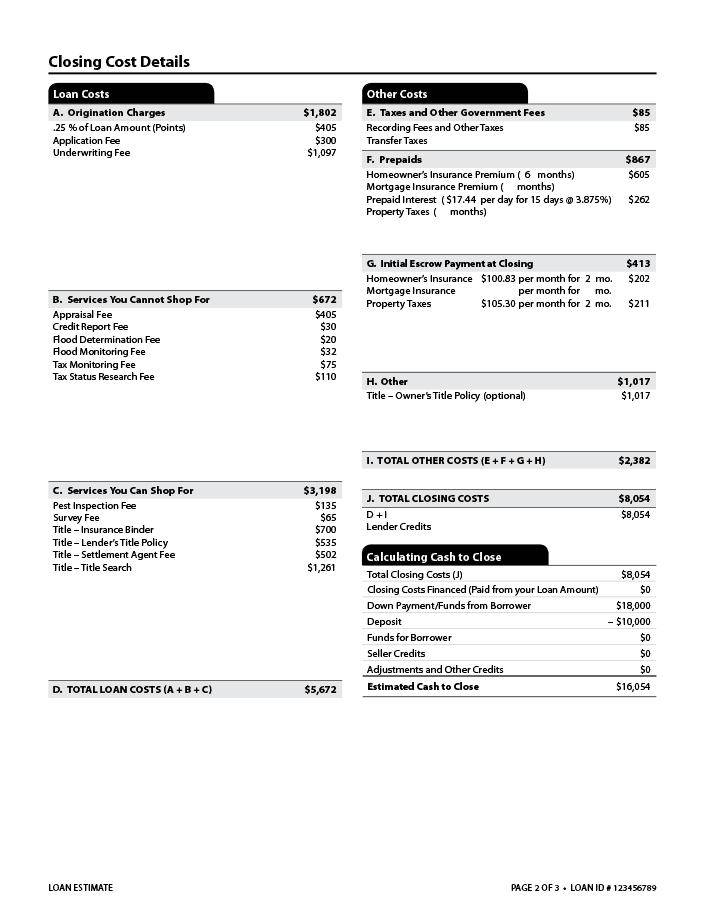

Closing Cost Details

Loan Costs

Upfront charges from your lender for making the loan.

A. Loan Cost

Origination charges are upfront fees charged by your lender

B. Service You Cannot Shop For

The services in this section are required by the lender and can't be changed by the borrower.

C. Service You Can Shop For

The services in this section are required by the lender, but you can save money by shopping for these services.

Other Cost

Costs associated with the real estate transaction transferring the property to you and costs associated with owning your home.

E.Taxes and Other Government Fees

Local governments charge recording fees and taxes to record the sale of property. These transfer taxes (another term for recording fees and taxes) vary from state to state.

F. Prepaids

When the buyer gets a loan, their lender may require them to pay for some things, like property taxes and homeowners or rental property insurance in advance (which are called prepaid costs). Prepaid costs are typically part of the buyer’s closing costs that need to be paid in advance when getting a loan.

Property taxes are set by your local or state government, not by the lender.

G. Intitial Escrow Payment at Closing

Give details about your escrow account payments. Refer to

Projected Payments on Page 1

H. Intitial Escrow Payment at Closing

Owner's title insurance provides protection to the homeowner if someone sues and says they have a claim against the home from before the homeowner purchased it.

Lenders require you to purchase a lender's title insurance policy, which protects the amount they lend.

Calculating Cash to Close

This section shows how the Estimated Cash to Close was calculated

Your Estimated Cash to Close is the estimated amount of money you will have to bring to closing.Your Estimated Cash to Close includes your down payment and closing costs, minus any deposit you have already paid to the seller, any amount the seller has agreed to pay toward your closing costs (seller credits), and other adjustments.

You will typically need a cashier's check or wire transfer for this amount at closing. The lender you choose will also need to document the source of the funds you bring to closing

Page 3

Additional Information About This Loan

Comparaisons

This section offers several useful calculations to compare the cost of this loan offer with other offers from different lenders. Because loan costs vary both across lenders and across different kinds of loans, it’s important to request Loan Estimates for the same kind of loan from different lenders.

An annual percentage rate (APR)

is a broader measure of the cost to you of borrowing money, also expressed as a percentage rate. In general, the APR reflects not only the interest rate but also any points, mortgage broker fees, and other charges that you pay to get the loan. For that reason, your APR is usually higher than your interest rate.

Total Interest Percentage (TIP)

This number helps you understand how much interest you will pay over the life of the loan and lets you make comparisons between loans.

Other Considerations

Appraisal

The lender uses an appraisal to decide how much your home is worth. The appraisal is conducted by an independent, professional appraiser. You have a right to receive a copy

Assumation*

If your loan allows assumptions, that means that if you sell the home, the buyer may be allowed to take over your loan on the same terms, instead of having to get a new loan. If your loan does not allow assumptions, the buyer will not be allowed to take over your loan. Most loans do not allow assumptions.

*Desjardins Bank does not allow assumption

Servicing*

Servicing means handling the loan on a day-to-day basis once the loan is made—for example, accepting payments and answering questions from borrowers. The lender can choose to service your loan itself, or transfer that responsibility to a different company.

*Desjardins Bank is seriving all his loans